How Much Can You Actually Save With A Variable Speed Pump?

In our previous article, we have already talked about why you should invest in a Variable Speed Pump so there’s no doubt that a variable speed pump is a superior choice and will save you money in the long run. Here we want to take a closer look at how much money a variable speed pump can actually save you and how it is calculated. There is so much discussion nowadays about energy efficiency and one thing you may not realise is just how much of an impact your pool equipment can make on your energy usage. This pie chart from Energy Rating’s E3 study shows that your pool pump can take up 18% of your household electricity consumption.

How does it work?

Single-speed pumps operate at only one fixed rate, even though that speed may not be necessary for a particular task. This means most of the time, you pay for the energy more than you really consume by using a single-speed pump. Variable speed pumps allow you to run filtration at different motor speeds (different flows) during the day. They allow you to run your pool at the optimum speed to get the job done. This creates less friction on your piping, filter, and accessories allowing your pool to run at a much lower energy level, as well as less wear and tear, saving you money and increasing the lifespan of your equipment. You can begin your filtration cycle with a similar speed to that of the single-speed pump, then run it for a longer amount of time at a slower speed to achieve the same turnover result.

How much are you saving?

The amount of electricity used by a pool pump is measured in units of Watt-hours (Wh) or Kilowatt-hours (kWh), where 1 kilowatt = 1,000 watts (W). The amount of electricity a pool pump uses depends on how many hours a day the pump is run and for how many days per year the power consumption of the pump, measured in watts, as well as the size of the pool. Here's how the calculation goes: Step 1: Volts (230 volts in Australia) x Amperage = watts Step 2: Watts/1,000 = kWh used by the pump Step 3: kWh x run time per day =kWh per day Step 4: Electrical rate x kWh per day=electricity running cost of your pump per day Credit: https://www.mrpoolman.com.au/blogs/news/standard-pool-pumps-vs-eco-pool-pumps-by-the-numbers

Check out the table below for a specific comparison:

But we would say the most significant difference might be the time of operation. The operation cost that keeps a variable speed pool pump 24-hours a day for a month will make any single speed pump run only 3-hours a day. Although the upfront cost of a variable-speed pump is higher, the cost savings in long-term care are a lot greater due to the reduction in energy bills. We recommend looking for a variable speed pool pump that has an energy rating of at least 8 stars. To see a list of pool pumps registered in a voluntary energy-rating scheme run by the Australian Government, please click here. This bar chart that illustrates the annual energy consumption of pool pumps by star rating shows you the difference your VS pump can make in energy consumption based on its star rating.

Credit: Decision Regulation Impact Statement: Swimming pool pumps

Always consult your local pool professionals to determine the most suitable pool pump for your needs.

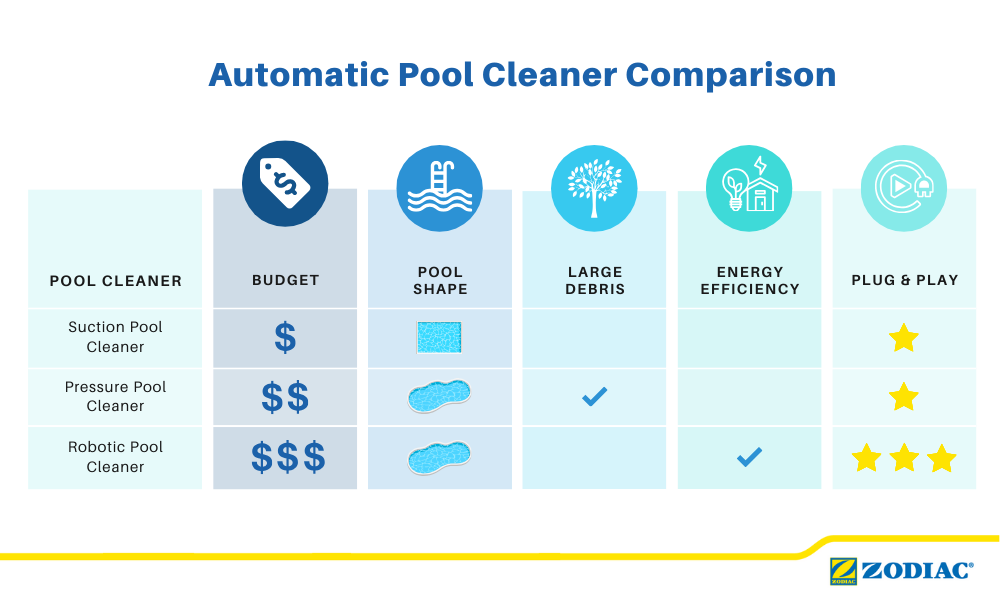

Five Factors to Consider When Buying an Automatic Pool Cleaner

Pool Size and Shape

The type of pool cleaner that is best for you largely depends on the dimensions and design of your pool. For smaller pools, a suction cleaner is often the most effective option. However, a robotic pool cleaner may be a better choice if you have a large pool with a lot of debris. Moreover, the design of your pool is also a crucial factor to consider. Pools with many corners and tight spaces are best suited for robotic pool cleaners equipped with swivel cords, which ensure seamless movement and prevent tangling in confined areas.

The Type of Debris

The type of debris present in your pool affects the choice of pool cleaner you should go for. For instance, if your pool has larger debris, such as leaves and twigs, a pressure pool cleaner is usually more effective. However, robotic pool cleaners that offer precision cleaning are more appropriate for pools with finer particles like sand and dirt. Special debris types like algae or pet hair require special consideration since different cleaners have varying abilities to handle them. Therefore, it's important to choose a cleaner well-suited to your pool's specific challenges.

Energy Efficiency

When you are selecting a pool cleaner, it's important to consider energy efficiency. Different types of cleaners have varying impacts on your energy usage. Robotic pool cleaners are known for their energy efficiency. They work independently from your pool's filtration system and usually come with energy-saving features. On the other hand, suction and pressure cleaners are connected to the pool's filtration system, which could increase your overall energy consumption. Therefore, if you prioritise energy efficiency, a robotic pool cleaner can be a better option that balances effective cleaning and lower energy costs.

Plug & Play

When selecting a pool cleaner, one critical aspect is the "plug and play" capability - essentially, how easy it is to set up and use the cleaner right out of the box. Suction pool cleaners are known for their simplicity, directly attached to the pool's existing filtration system. While this means fewer additional setups, it also means limited functionality. Pressure pool cleaners, which connect to a pool's return line, often require an additional booster pump for optimal performance. This additional requirement means more setup time and potentially higher energy costs. However, they are better at picking up larger debris and reducing wear on your pool's main filtration system.

Robotic pool cleaners are at the forefront of convenience and efficiency in pool maintenance. They operate independently of your pool's system and are equipped with their own filtration system, so you just plug and place them in the pool. While suction and pressure pool cleaners have their benefits, they fall short in the plug-and-play aspect when compared to robotic cleaners. If convenience and efficiency are your top priorities, a robotic pool cleaner is a clear winner.

Price and Warranty

When you're in the market for a pool cleaner, it's important to consider both the price and the warranty. Pool cleaners come in various price ranges, with some being more affordable and others being more expensive, but with long-term savings in energy efficiency and durability. For example, a high-end robotic pool cleaner may cost more initially, but it could offer better longevity and energy efficiency in the long run. Additionally, it's essential to have a comprehensive warranty that covers critical components like the motor. As a general rule, the cheaper the cleaner, the shorter the lifespan, so keep this in mind when comparing models.

Type of Pool Cleaners

Now that we have gone over the crucial factors to consider, including debris type, energy efficiency, convenience, and price, it is time to delve deeper into the three main types of pool cleaners: suction, pressure, and robotic. Each type offers distinct advantages that cater to varying pool requirements.

Suction Pool Cleaner

Suction pool cleaners are similar to how a vacuum cleaner works. They operate when the pool pump is active and attached to the pool's skimmer box. These cleaners move around the pool, collecting dirt and debris by suctioning it into the skimmer basket. A suction pool cleaner is ideal for those who don't have many trees or leaves around, and heavy debris rarely enters the pool. They are also a solid option for those on a budget, as they are typically cheaper to install than pressure cleaners.

Pressure Pool Cleaner

Pressure pool cleaners are operated through a dedicated return line and powered by water pressure from the pump, which can be either the main circulation pump or a separate booster pump. This water pressure propels the cleaner around the pool and forces debris into a bag. The benefits of using a pressure cleaner are numerous, including:

The ability to collect large debris such as gum nuts, twigs, and heavy leaf litter is perfect for pools frequently exposed to larger debris.

Most pools can be cleaned in less than 3 hours

Leaves are sucked into a separate bag instead of your filter or pump basket, which helps take the load off your filtration system.

Robotic Pool Cleaner

Robotic pool cleaners, increasingly popular for their efficiency and advanced features, stand out for their independence from the pool filtration system, extending the life of the pool pump and filter and significantly reducing water usage through decreased backwashing. They are self-contained units that gather dirt and debris in an inbuilt bag or cartridge within the cleaner. Known for their advanced intelligence, robotic cleaners ensure they don't get stuck in corners or on steps. They are also known for their energy efficiency, using a low-voltage motor that can cut pool running costs considerably. While they are slightly more expensive, they do provide a more thorough and complete clean than any other cleaner.

Bottom Line

To choose the right pool cleaner, it's essential to consider various factors. These factors include the debris size, the size of the pool, energy efficiency, and your budget. There are three types of pool cleaners: suction, pressure, and robotic. Suction cleaners are less expensive and work well for pools with minimal debris. Pressure cleaners are more effective for cleaning larger debris. Robotic cleaners are the most advanced and energy-efficient option. When making a decision, it's important to consider your specific pool requirements, practicality and cost-effectiveness. Ultimately, the right choice will ensure a clean and enjoyable swimming experience for you.

If you're still unsure about which cleaner will best suit your pool, we encourage you to speak to your local pool professional for guidance around selecting a cleaner with your budget and situation in mind.

Recommended Products

Similar Guides

5 Reasons Why Your Pool Is Still Green Or Cloudy After Shocking

Nothing beats going for a dip in your pool on a beautiful summer day. You go to your backyard only to be greeted with a pool that looks like it’s been on a week-long bender.

That’s right. You’ve got a green pool! :(